The number of countries involved in the space economy has grown from just two in 1950s to over 90 in 2022 (Ellerbeck, 2022). Likewise, the space industry is expected to keep growing in the near future. According to the Space Foundation’s Space Report 2022 Q2, the space economy was valued at US$469 billion (SWG, 2022). However, Bank of America has predicted this figure to grow to over US$1.4 trillion by 2040 (Foroohar, 2022).

The space economy encompasses many areas such as space exploration, manned expeditions, and mining. However, much of the current economic value of the space industry comes from satellites. In 2021, Bryce Tech and the Satellite Industry Association reported that 72% of the space industry’s revenue came from this sector (Pongruber, n.d.). The satellite industry can be broken down into four sectors: launching, ground systems, manufacturing, and applications.

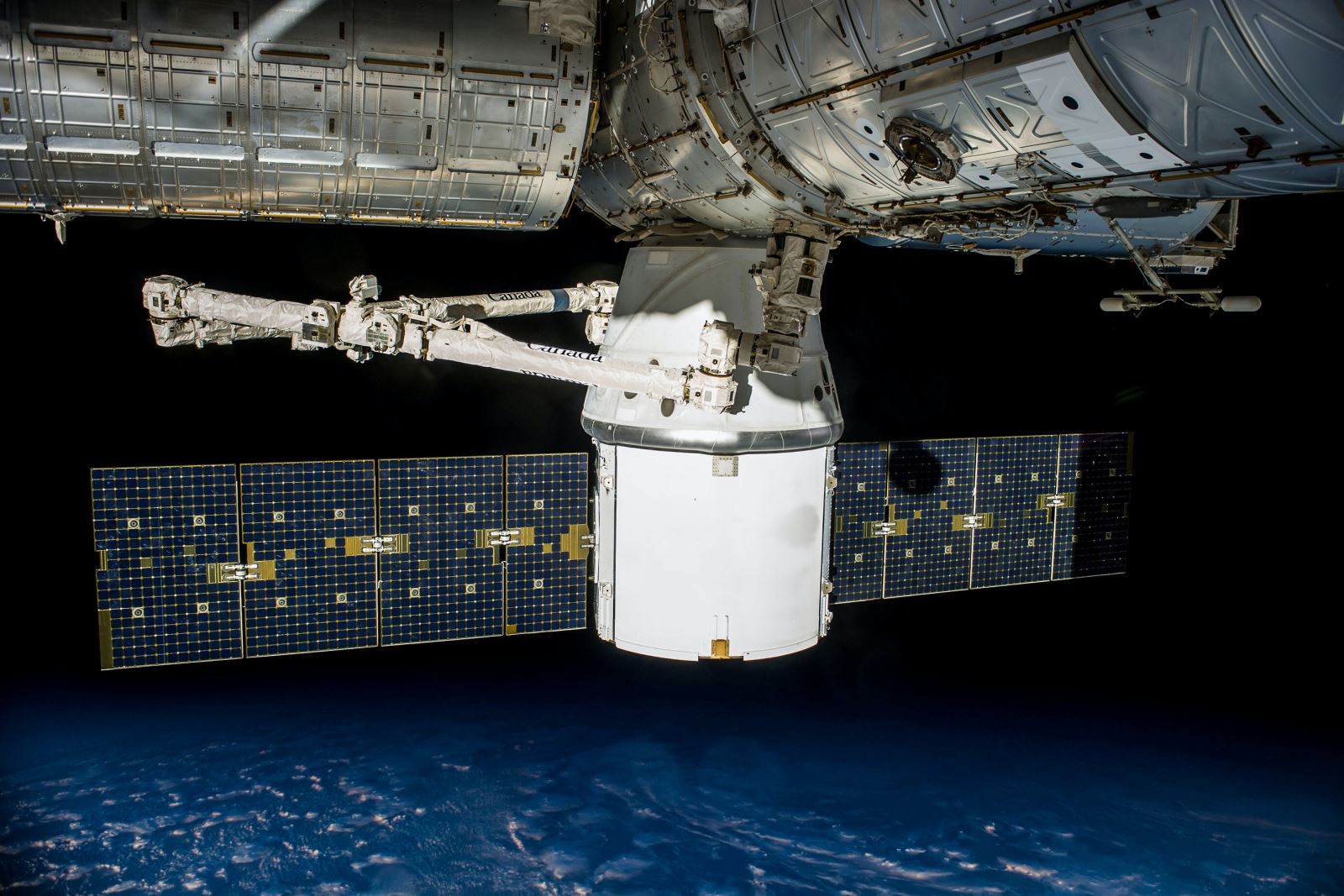

Resource:Photographer SpaceX on Pexels

Launching

The launch sector still has a relatively high barrier to entry due to high upfront costs, interoperability issues, and the lack of a workforce with relevant skills (AMR, 2020). Due to these limitations, the government and military traditionally constructed and operated most launch facilities. According to Statista research, only 11 countries have the capacity to launch their own space rockets (Buchholz, 2022).

Therefore, there’s been a push to develop indigenous launch capabilities as satellites are increasingly seen as an integral part of national defense. During wartime, those without indigenous capabilities fear that operators in other countries won’t be willing to launch critical equipment necessary for communications and surveillance (Damp, 2021).

Aside from security concerns, the public sector hopes to develop indigenous launch capabilities to attract further direct foreign investment. Many advanced satellite manufacturers in the private sector often relocate next to launch sites to shorten their supply chain and cut down on costs (Damp, 2021).

Seraphim Space, a major investor in space technology, recently said that compared with the 1980s, the cost of sending payloads into space has been reduced by 100-1000 times (Gordon, 2022). These reduced costs further incentivize satellite companies to enter the market, which in turn creates more demand for launch facilities (AMR, 2020).

Ground Systems

Even though the ground systems segment of the satellite industry is predicted to be valued at US$53.7 billion in 2026, most development has been focused on launching and manufacturing (Labrador, 2022). Therefore, many experts in the field fear that an underdeveloped ground systems ecosystem may hinder the full potential of satellite applications in the near future (Presgraves, 2021). In the past, organizations such as the US National Ocean and Atmospheric Administration specifically built unique ground systems for each particular mission (Werner, 2023). This is partly due to older geosynchronous equatorial orbit (GEO) satellites staying in a fixed position above the earth and only needing one ground system location (ES, 2020).

However, newer LEO satellites constantly rotate the Earth and require a chain of ground systems across the globe to receive and transmit signals. Most LEO satellite startups don’t have the capital to build their own extensive network of ground equipment. Therefore, small satellite operators are looking for solutions in the ground segment as a service (GSaaS) industry. According to Euroconsult, the current 300 GSaaS operators will expand to 600 by 2030 (Stockley, 2021).

Many small satellite companies are hoping that in the future, ground system operators will standardize their hardware across the industry. In such an ecosystem, virtualized ground systems will become interoperable, giving small satellite companies access to expensive hardware networks across the globe via cloud technology (NSR, 2021). Such integration will turn ground system hardware into a more profitable scalable commodity, which will incentivize further investment and growth in the sector (Labrador, 2022).

Manufacturing

The satellite manufacturing industry is divided by “application, type, size, and region” (Mayank, 2022). The two main types of satellites in operation today are low earth orbit (LEO) satellites and geosynchronous equatorial orbit (GEO) satellites. GEO satellites are large, placed in a fixed position around 36,000 km away from the equator, and rotate in the same direction and speed as the Earth.

In contrast, LEO satellites are smaller than their GEO counterparts and in constant orbit 500-1500 km from the Earth (Mann, 2022). In the past, the market was dominated by large GEO satellites, which provided constant coverage of one section of the earth, usually for GPS and television. More recent LEO satellites are smaller, less expensive, and are used in applications that require lower latency such as high-speed internet.

To provide unbroken coverage, LEO satellites operate in large constellations as they rotate the Earth (Brukardt, 2022). According to Mordor Intelligence, the recent demand for LEO satellites is increasing due to the “growing connectivity of electronic devices” and a “greater need for Earth Observation” (MI, n.d.) These applications have created a large incentive to innovate and cut costs in the satellite manufacturing sector.

One such innovation is the rising popularity of smaller satellites such as CubeSats. Unlike large GEO satellites that weigh up to 6,500 kg, are mission-specific, and sometimes need dedicated rockets (Miller, 2021), CubeSats are small satellites weighing around 10 kg, utilize standardized equipment, and can be launched as auxiliary payloads of other missions (IMARC, n.d.). For instance, SpaceX’s first launch of 2023, carried 114 small satellites from 23 countries into orbit on a single rocket (Clark, 2023).

Ease of assembly, mass production, and technical innovation have made getting products into space much cheaper (MAM, n.d.). This has prompted many smaller private companies to enter the manufacturing market for small LEO satellites.

Applications (Communication):

According to the Union of Concerned Scientists, most satellites in orbit today are used for communication. From December 2020 to 2022, the total number of communication satellites increased by 71.12% to 3,135 (Mohanta, 2022). This number may skyrocket to 50,000 by 2030 due to an explosion in the demand for bandwidth and connectivity.

Most new communication satellites will be small LEO satellites that act in large constellations at low orbit. The aim is to provide low-latency internet connection anywhere on Earth so users can "download high-definition movies [and] also play games and shop online” (Daehnick, 2020). The growth of LEO satellites will bring internet connectivity to users in remote locations where service was previously unavailable (RL, 2022).

Despite growing demand, the US$5 billion to US$10 billion it takes to set up a constellation acts as a huge financial barrier to enter the market, especially when compared with a single earth observation satellite. However, the ever-growing appetite for mobile internet coverage may incite further public funding into the sector, especially to provide internet access to rural areas in developed nations (Daehnick, 2020).

Conclusion

In recent years, the space industry has attracted interest from both the public and private sectors. The former sees having an indigenous space industry as a matter of national security while the latter is interested in the sector’s massive commercial potential.

However, developing the next generation of space technology will take significant capital outlays. Therefore, the public sector may have to continue to fund private sector innovations that power uninterrupted communications and remote sensing across the globe. The following article will explore the participation of individual New Southbound partner countries in this rapidly growing industry.

Sources